Tighter cryptocurrency regulation is inevitable after the collapse of exchange FTX. Even so, there will still be places that the rules don’t touch. Big players like Binance, as well as services based on so-called decentralised finance, may stay out of reach. That ensures the edgier aspects of crypto will live on.

The second problem will be pinning down companies based elsewhere. Take Binance, by the far largest crypto exchange. It has an affiliated American business, Binance.US, but that company is tiny relative to the parent. The danger is that regulators in their back yard can’t see what’s happening in someone else’s. Global co-ordination has proved challenging on other issues like minimum corporate tax rates; a common framework for something as complex as crypto is a pipe dream.

The industry’s best hope is that regions with clear, customer-friendly rules will attract big institutional money and protect retail traders. But borders are porous, and money finds a way to where the biggest rewards are on offer. Bankman-Fried initially said the U.S. division of FTX was insulated from the problems at his Bahamas-based exchange. Still, on Friday it filed for bankruptcy alongside the wider group. The coming wave of regulation may protect the good, but it won’t stop the reckless.

FTX filed for bankruptcy on Nov. 11, after traders rushed to withdraw $6 billion from the platform in just 72 hours and rival exchange Binance abandoned a proposed rescue deal. Bitcoin was trading at roughly $16,600 at 0835 GMT on Nov. 17, compared with around $20,500 at the start of the month.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Breakingviews - Crypto readies itself for a post-FTX hose-down: podcastThe collapse of Sam Bankman-Fried’s empire exposed the vulnerabilities of a vast, unregulated world of digital finance. Rivals like Circle CEO Jeremy Allaire hope to prove there’s a safer side of crypto worth saving. He presents his case in this episode of The Exchange podcast.

Breakingviews - Crypto readies itself for a post-FTX hose-down: podcastThe collapse of Sam Bankman-Fried’s empire exposed the vulnerabilities of a vast, unregulated world of digital finance. Rivals like Circle CEO Jeremy Allaire hope to prove there’s a safer side of crypto worth saving. He presents his case in this episode of The Exchange podcast.

Consulte Mais informação »

The Fall of Crypto's Golden Boy - The Journal. - WSJ PodcastsUntil last week, FTX founder Sam Bankman-Fried was the face of crypto. Admirers saw him as an approachable, friendly billionaire eager to deploy his wealth for good. Then his crypto empire imploded, leaving hundreds of thousands of investors’ assets in doubt. WSJ’s Greg Zuckerman profiles the man behind FTX. Further Reading: -How FTX’s Sam Bankman-Fried Went From Crypto Golden Boy to Villain -FTX Tapped Into Customer Accounts to Fund Risky Bets, Setting Up Its Downfall -Alameda, FTX Executives Are Said to Have Known FTX Was Using Customer Funds -FTX’s Collapse Leaves Employees Sick With Anger Further Listening: -How Crypto Giant FTX Suddenly Imploded

The Fall of Crypto's Golden Boy - The Journal. - WSJ PodcastsUntil last week, FTX founder Sam Bankman-Fried was the face of crypto. Admirers saw him as an approachable, friendly billionaire eager to deploy his wealth for good. Then his crypto empire imploded, leaving hundreds of thousands of investors’ assets in doubt. WSJ’s Greg Zuckerman profiles the man behind FTX. Further Reading: -How FTX’s Sam Bankman-Fried Went From Crypto Golden Boy to Villain -FTX Tapped Into Customer Accounts to Fund Risky Bets, Setting Up Its Downfall -Alameda, FTX Executives Are Said to Have Known FTX Was Using Customer Funds -FTX’s Collapse Leaves Employees Sick With Anger Further Listening: -How Crypto Giant FTX Suddenly Imploded

Consulte Mais informação »

TSM FTX drops FTXFTX had signed a huge sponsorship deal with TSM.

TSM FTX drops FTXFTX had signed a huge sponsorship deal with TSM.

Consulte Mais informação »

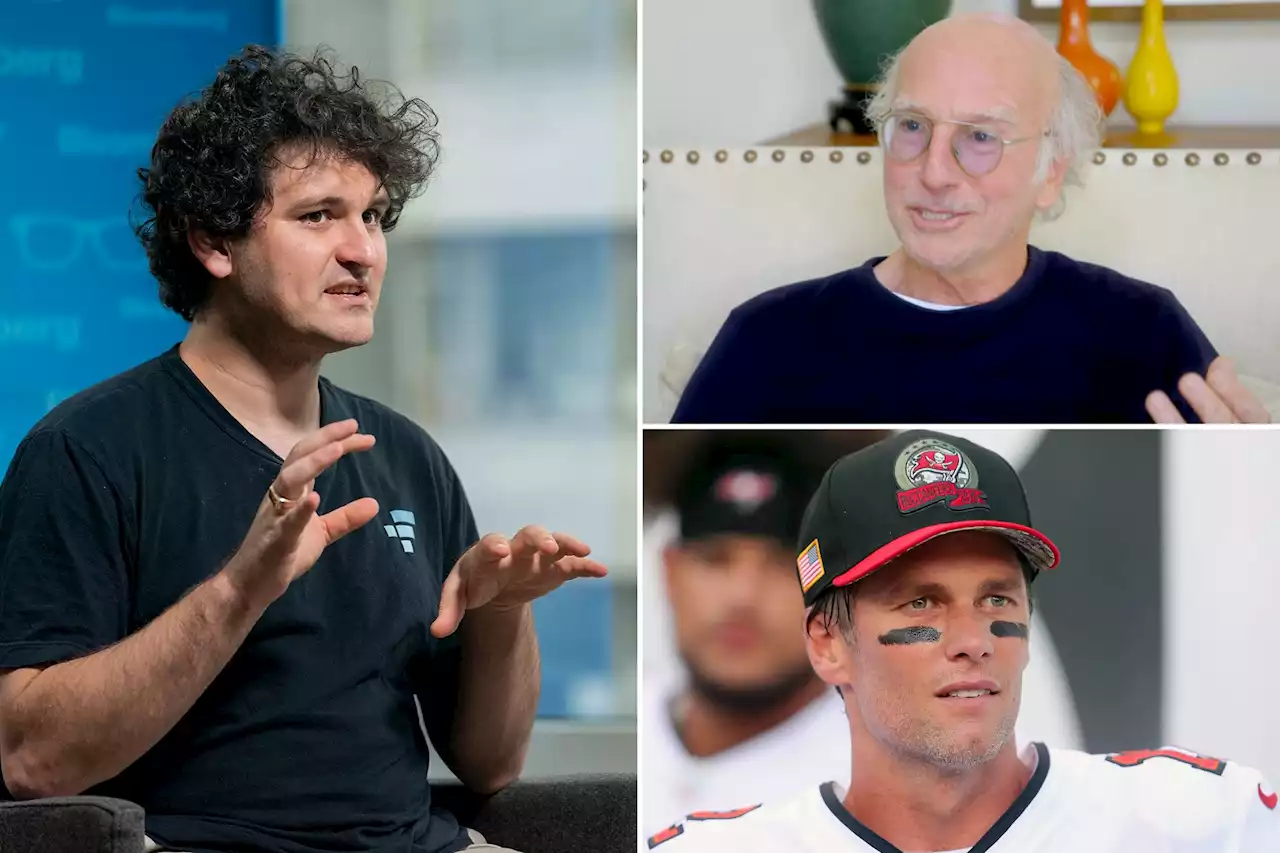

FTX lawsuit: Investor sues Tom Brady, Gisele Bundchen, Steph Curry as crypto contagion spreads'The deceptive FTX platform maintained by the FTX entities was truly a house of cards,' the proposed class-action lawsuit states.

FTX lawsuit: Investor sues Tom Brady, Gisele Bundchen, Steph Curry as crypto contagion spreads'The deceptive FTX platform maintained by the FTX entities was truly a house of cards,' the proposed class-action lawsuit states.

Consulte Mais informação »

Tom Brady, Gisele Bündchen, Larry David sued by crypto investors after FTX collapseTom Brady, ex-wife Gisele Bündchen, Larry David, and sports stars like David Ortiz and Steph Curry were named in the lawsuit.

Tom Brady, Gisele Bündchen, Larry David sued by crypto investors after FTX collapseTom Brady, ex-wife Gisele Bündchen, Larry David, and sports stars like David Ortiz and Steph Curry were named in the lawsuit.

Consulte Mais informação »

FTX Exploiter Swaps Thousands of Stolen BNB Crypto Tokens Into Ether, BUSDThe FTX_Official attacker has swapped the stolen funds at the same time over the past few days, and it is unclear why they are being converted into ether and BUSD specifically. By shauryamalwa.

FTX Exploiter Swaps Thousands of Stolen BNB Crypto Tokens Into Ether, BUSDThe FTX_Official attacker has swapped the stolen funds at the same time over the past few days, and it is unclear why they are being converted into ether and BUSD specifically. By shauryamalwa.

Consulte Mais informação »