Bank of England boss warns of more financial pain to come after yet another interest rate rise

Homeowners have been warned things could get even worse as the Bank of England said it could not rule out further interest rate rises in a bid to bring down rampant inflation. Families already crippled by soaring food and energy prices were yesterday dealt another blow with mortgage repayments rising due to another rate hike, the Mirror reports.

Angry homeowners told on radio shows yesterday of their anguish caused by the latest interest rate rise. On LBC, caller Rachel in Bristol said: “I haven’t lived at my home since I was 25, I’m now 43 this year and I’m actually going to be selling my house and moving back in with my parents.Mum Jennifer from the Isle of Man told BBC 5 Live her and her partner’s monthly payments have gone from £725 a month to £1,120.

Shadow Chancellor Rachel Reeves said: “The Prime Minister should take his fingers out of his ears and admit his personal responsibility for a Tory mortgage crisis leaving so many worse off. He trapped us in a cycle of low growth and high taxes, while tickling the tummies of unfunded, trickle down tax extremists in his party.”

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

Consulte Mais informação »

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Consulte Mais informação »

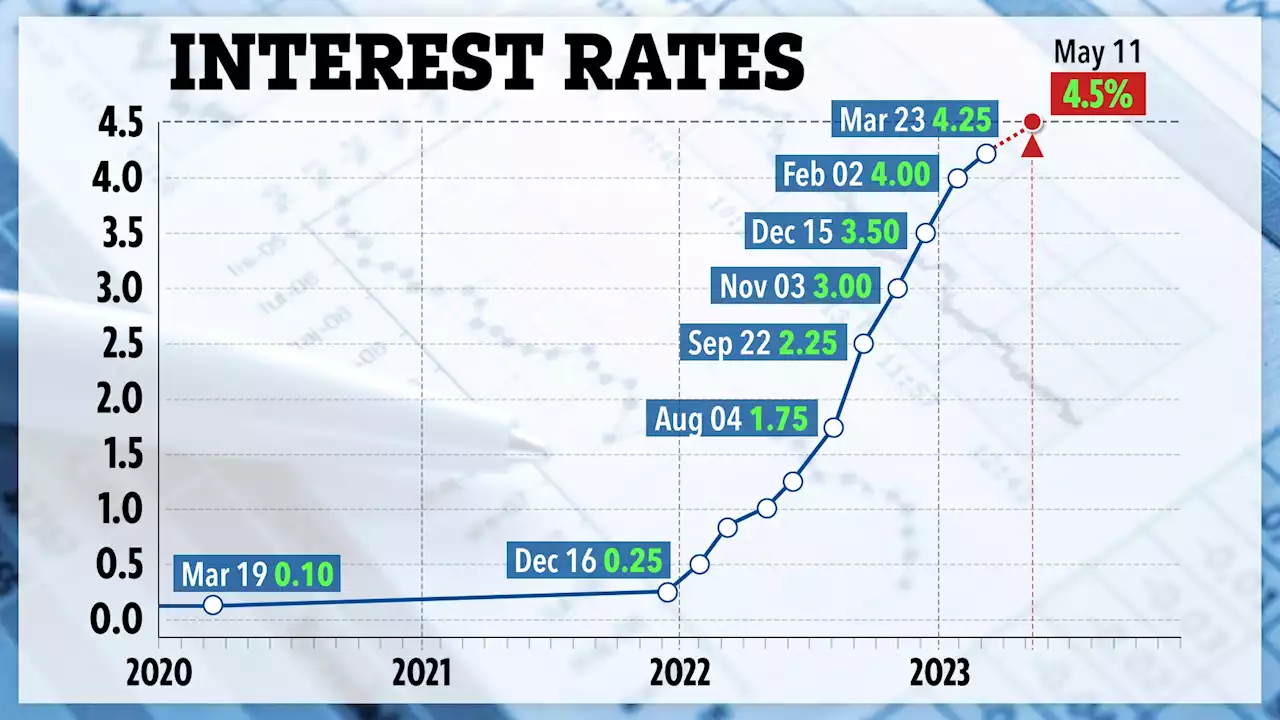

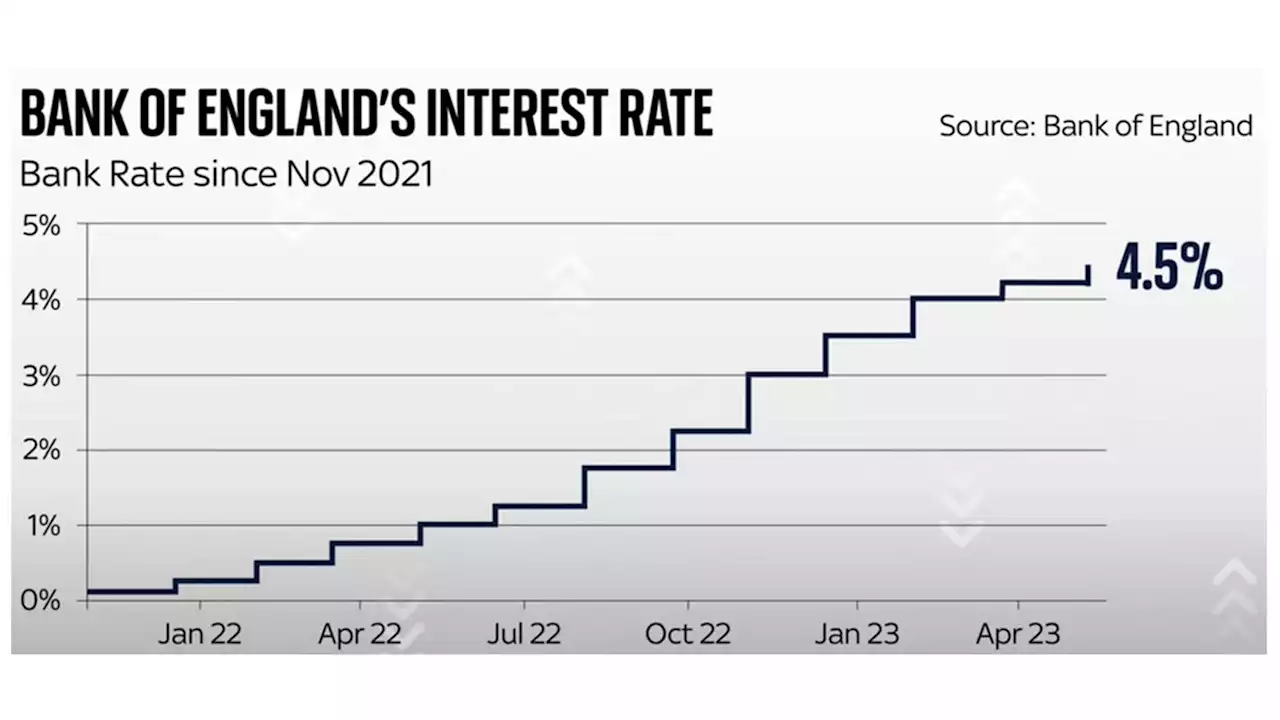

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Consulte Mais informação »

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Consulte Mais informação »

House prices were going to fall anyway - the Bank of England is just helping them alongThe Bank of England is making it clear that the era of cheap credit is well and truly over While it’s unlikely that there will be a housing market crash like the one seen after the 2008 global financial crisis, a downturn is likely 🏠 Victoria_Spratt

House prices were going to fall anyway - the Bank of England is just helping them alongThe Bank of England is making it clear that the era of cheap credit is well and truly over While it’s unlikely that there will be a housing market crash like the one seen after the 2008 global financial crisis, a downturn is likely 🏠 Victoria_Spratt

Consulte Mais informação »

Bank of England interest rate increased 0.25 percentage points to 4.5%The Bank of England has raised interest rates for a record-breaking 12th successive meeting, lifting the cost of borrowing to 4.5% and warning that inflation would be higher this year than it previously anticipated

Bank of England interest rate increased 0.25 percentage points to 4.5%The Bank of England has raised interest rates for a record-breaking 12th successive meeting, lifting the cost of borrowing to 4.5% and warning that inflation would be higher this year than it previously anticipated

Consulte Mais informação »