AUD/USD retreats from 200-day SMA barrier, weaker USD limits any meaningful slide – by hareshmenghani AUDUSD Fed Inflation RiskAppetite Currencies

ing in the vicinity of the 0.6700 mark on Tuesday. Spot prices retreat to the lower end of the daily range, around the 0.6680-0.6675 region, though lack follow-through and remain well within a familiar trading band held over the past week or so.

The modest intraday pullback, meanwhile, lacks any obvious fundamental catalyst and is more likely to remain cushioned in the wake of the prevailing bearish sentiment surrounding the US Dollar . Speculations that the Federal Reserve has limited headroom to keep raisingand is nearing the end of its rate-hiking cycle drag the USD Index , which tracks the Greenback against a basket of currencies, to a two-month low.

The closely-watched US employment details released on Friday showed that the economy added the fewest jobs in 2-1/2 years in June and indicated that the labor market is cooling. Furthermore. the New York Fed's monthly survey revealed on Monday that the one-year consumer inflation expectation dropped to 3.8% in June - the lowest level since April 2021.

Apart from this, a stable performance around the equity markets further dents the Greenback's relative safe-haven status and should benefit the risk-sensitive Aussie. That said, repeated failures near a technically significant 200-day SMA make it prudent to wait for some follow-through buying before placing fresh bullish bets around the AUD/USD pair.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

AUD/USD remains below 0.6700/200-day SMA, moves little after Chinese inflation dataThe AUD/USD pair struggles to capitalize on Friday's strong positive move and remains below the 0.6700 mark, or a technically significant 200-day Simp

AUD/USD remains below 0.6700/200-day SMA, moves little after Chinese inflation dataThe AUD/USD pair struggles to capitalize on Friday's strong positive move and remains below the 0.6700 mark, or a technically significant 200-day Simp

Consulte Mais informação »

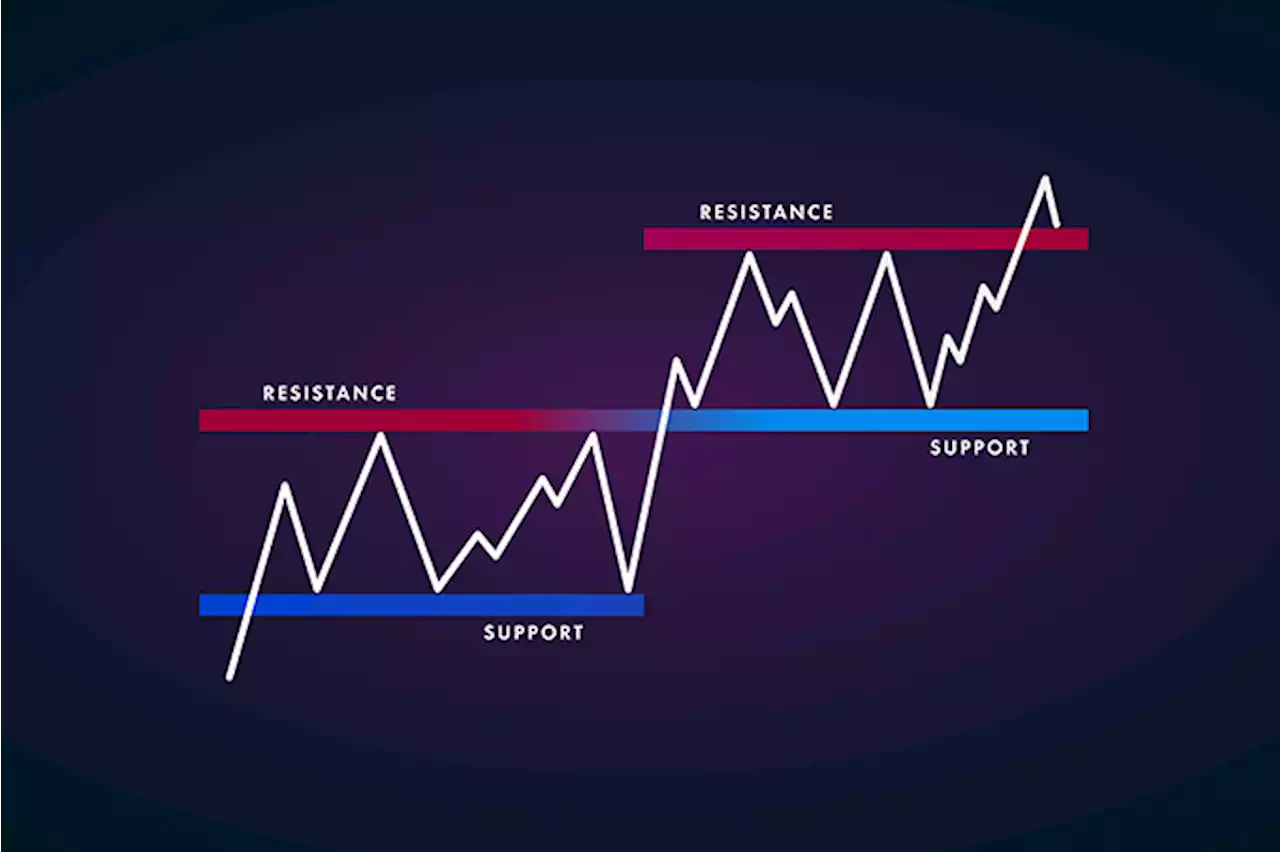

Trading Support and Resistance \u2013 AUD/USD, USD/CADLast week was dominated by relative strength in the Japanese Yen, and relative weakness in the US Dollar. Find out which currency pairs are going to be worth watching this week here:

Trading Support and Resistance \u2013 AUD/USD, USD/CADLast week was dominated by relative strength in the Japanese Yen, and relative weakness in the US Dollar. Find out which currency pairs are going to be worth watching this week here:

Consulte Mais informação »

AUD/USD kicks off the week on the front foot near 0.6700, China’s inflation eyedAUD/USD is seeing a positive start to the key United States Consumer Price Index (CPI) week, as Aussie bulls cheer Friday’s sharp sell-off in the US D

AUD/USD kicks off the week on the front foot near 0.6700, China’s inflation eyedAUD/USD is seeing a positive start to the key United States Consumer Price Index (CPI) week, as Aussie bulls cheer Friday’s sharp sell-off in the US D

Consulte Mais informação »

AUD/USD faces some consolidation near term – UOBIn the opinion of UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang, AUD/USD is now seen trading within the 0.6620-0.6750 range

AUD/USD faces some consolidation near term – UOBIn the opinion of UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang, AUD/USD is now seen trading within the 0.6620-0.6750 range

Consulte Mais informação »

AUD/USD to be in a narrow range over the near term – HSBCAUD/USD is set to move in a narrow range over the near term, in the view of economists at HSBC. AUD/USD to be pushed higher by shorter-term yield diff

AUD/USD to be in a narrow range over the near term – HSBCAUD/USD is set to move in a narrow range over the near term, in the view of economists at HSBC. AUD/USD to be pushed higher by shorter-term yield diff

Consulte Mais informação »

AUD/USD stretches downside to near 0.6630 as Fed gets reason to resume policy tighteningAUD/USD stretches downside to near 0.6630 as Fed gets reason to resume policy tightening – by Sagar_Dua24 AUDUSD RBA Fed InterestRate DollarIndex

AUD/USD stretches downside to near 0.6630 as Fed gets reason to resume policy tighteningAUD/USD stretches downside to near 0.6630 as Fed gets reason to resume policy tightening – by Sagar_Dua24 AUDUSD RBA Fed InterestRate DollarIndex

Consulte Mais informação »