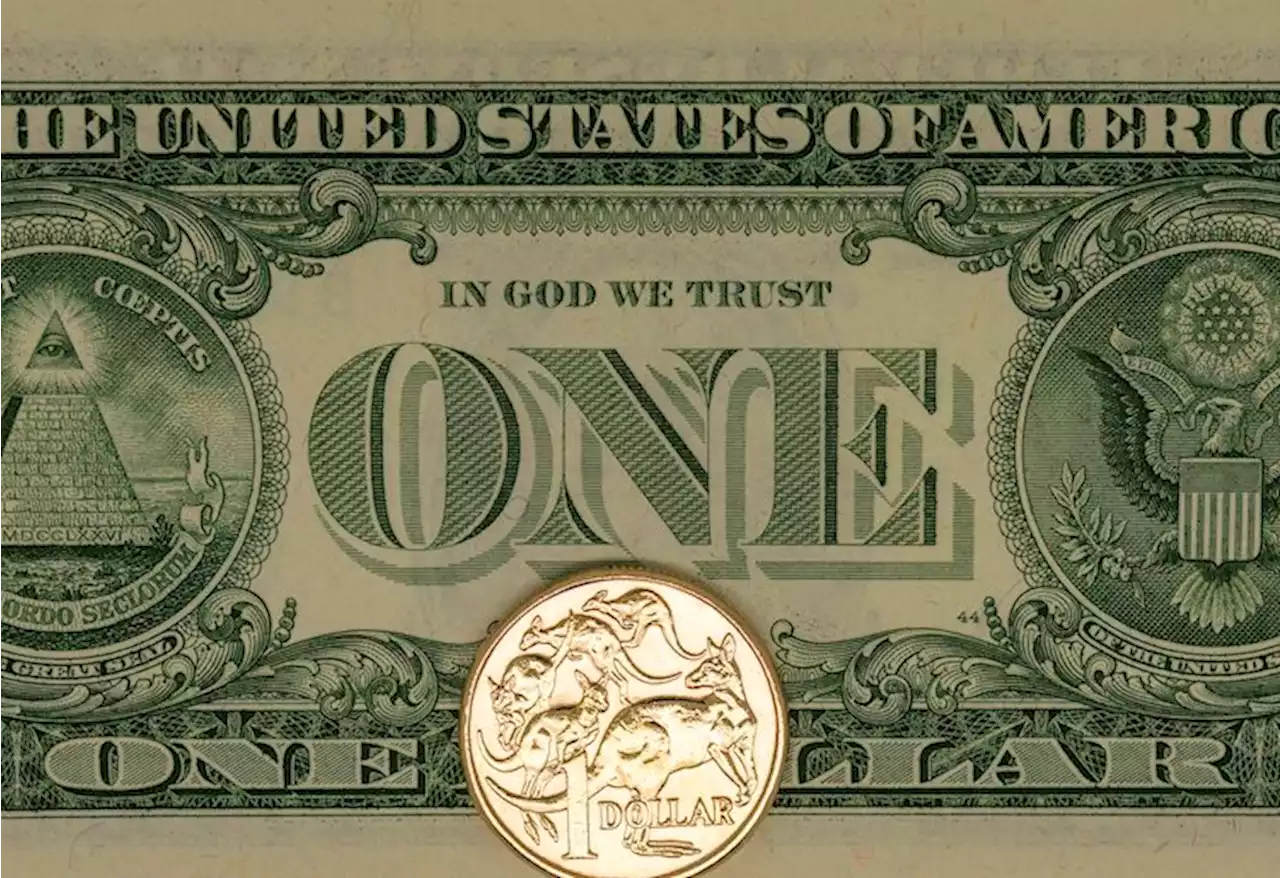

AUD/USD licks its wounds near 0.6900 ahead of Aussie employment data – by anilpanchal7 AUDUSD Employment RiskAppetite Fed RBA

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

AUD/USD steadies near 0.6960 despite upbeat Aussie NAB data, focus on US inflationAUD/USD seesaws around 0.6970-60 as it lacks upside momentum amid cautious markets during the early hours of all-important Tuesday. While portraying t

AUD/USD steadies near 0.6960 despite upbeat Aussie NAB data, focus on US inflationAUD/USD seesaws around 0.6970-60 as it lacks upside momentum amid cautious markets during the early hours of all-important Tuesday. While portraying t

Consulte Mais informação »

AUD/USD retreats towards 0.6950 ahead of RBA Governor Lowe’s speech, US Retail SalesAUD/USD prints mild losses around 0.6980, the first in three days, as market players await the next round of catalysts during early Wednesday after th

AUD/USD retreats towards 0.6950 ahead of RBA Governor Lowe’s speech, US Retail SalesAUD/USD prints mild losses around 0.6980, the first in three days, as market players await the next round of catalysts during early Wednesday after th

Consulte Mais informação »

AUD/USD Price Analysis: Volatility contracts as investors await US InflationThe AUD/USD pair is looking for demand after a minor correction to near 0.6950 in the Tokyo session. The Aussie asset is expected to display a sideway

AUD/USD Price Analysis: Volatility contracts as investors await US InflationThe AUD/USD pair is looking for demand after a minor correction to near 0.6950 in the Tokyo session. The Aussie asset is expected to display a sideway

Consulte Mais informação »

AUD/USD consolidates in a narrow range above mid-0.6900s, US CPI awaitedThe AUD/USD pair struggles to capitalize on the previous day's goodish rebound from sub-0.6900 levels and oscillates in a narrow band through the earl

AUD/USD consolidates in a narrow range above mid-0.6900s, US CPI awaitedThe AUD/USD pair struggles to capitalize on the previous day's goodish rebound from sub-0.6900 levels and oscillates in a narrow band through the earl

Consulte Mais informação »

AUD/USD Price Analysis: Bears are dominating the bias with eye son break of 0.6900In the opening article for the week on AUD/USD, AUD/USD Price Analysis: Key support in play with eyes on 0.6900/50 for the opening range, it was state

AUD/USD Price Analysis: Bears are dominating the bias with eye son break of 0.6900In the opening article for the week on AUD/USD, AUD/USD Price Analysis: Key support in play with eyes on 0.6900/50 for the opening range, it was state

Consulte Mais informação »

AUD/USD stays below 0.7000 as RBA’s Lowe fails to copy hawkish Fed signalsAUD/USD holds lower ground near 0.6980 after Reserve Bank of Australia (RBA) Governor Philip Lowe’s Testimony during the mid-Asian session on Wednesda

AUD/USD stays below 0.7000 as RBA’s Lowe fails to copy hawkish Fed signalsAUD/USD holds lower ground near 0.6980 after Reserve Bank of Australia (RBA) Governor Philip Lowe’s Testimony during the mid-Asian session on Wednesda

Consulte Mais informação »