AUD/USD advances towards 0.6900 despite renewed US Inflation recovery concerns – by Sagar_Dua24 AUDUSD Fed RBA Inflation Employment

AUD/USD is marching towards 0.6900 as investors have ignored signs of recovery in the US Inflation.

The US has warned China if it decides to provide lethal military aid to Russia for its invasion of Ukraine.pair is struggling to extend its upside move above the immediate resistance of 0.6880 in the early Tokyo session. The upside bias for the Aussie asset is still favored as the risk profile is still solid. The major is expected to continue its upside to near the round-level resistance of 0.6900 despite renewed concerns of a rebound in the United States inflation.

S&P500 futures witnessed some losses on Friday and ended the week with mild losses as fresh concerns about a rebound in the US raised red flags for economic recovery. The odds are favoring the continuation of policy tightening by the Federal Reserve as the battle against stubborn inflation is getting complicated. The trading activity is expected to remain light as the US markets are closed on Monday because of President’s Day.

The US ambassador to the United Nations, Ambassador Linda Thomas-Greenfield, said Sunday that China would cross a “red line” if the country decided to provide lethal military aid to Russia for its invasion of Ukraine. This might impact the is looking for a cushion around 103.50 after a perpendicular downside move.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

AUD/USD fluctuates around 0.6877 though ended the week with lossesThe Australian dollar (AUD) finished the week on a lower note, after hitting a daily high of 0.6884, dropped on a risk-off impulse, as Wall Street end

AUD/USD fluctuates around 0.6877 though ended the week with lossesThe Australian dollar (AUD) finished the week on a lower note, after hitting a daily high of 0.6884, dropped on a risk-off impulse, as Wall Street end

Consulte Mais informação »

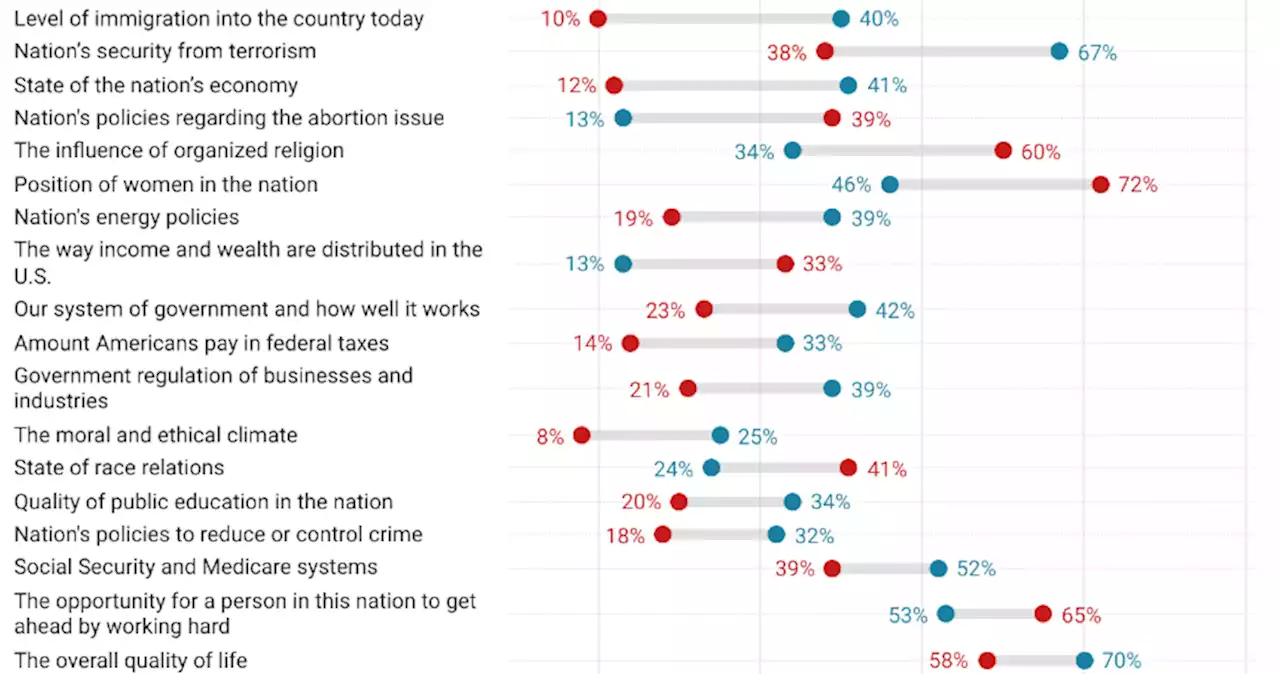

Crime, Inflation, Homelessness: Partisans Align on Dissatisf...On what issues do Republicans and Democrats agree – and disagree – on areas of life satisfaction? A new poll helps answer the question, and shows us that there's more common ground that we might imagine.

Crime, Inflation, Homelessness: Partisans Align on Dissatisf...On what issues do Republicans and Democrats agree – and disagree – on areas of life satisfaction? A new poll helps answer the question, and shows us that there's more common ground that we might imagine.

Consulte Mais informação »

Fed's Barkin: 'Slow progress' on inflation, sees more hikesA top Federal Reserve official is downplaying recent signs that the economy is strengthening, but also said he is prepared to keep raising interest rates in smaller increments as often as needed to quell inflation.

Fed's Barkin: 'Slow progress' on inflation, sees more hikesA top Federal Reserve official is downplaying recent signs that the economy is strengthening, but also said he is prepared to keep raising interest rates in smaller increments as often as needed to quell inflation.

Consulte Mais informação »

The Fed’s favorite inflation gauge will be the big market hurdle of next weekWorries about high inflation continue to weigh on investors' minds, as hotter-than-expected data this week showed the stubbornness of lofty prices.

The Fed’s favorite inflation gauge will be the big market hurdle of next weekWorries about high inflation continue to weigh on investors' minds, as hotter-than-expected data this week showed the stubbornness of lofty prices.

Consulte Mais informação »

How inflation is fueling the popularity of rewards credit cardsAs Americans continue to feel the cost crunch of inflation, many people are turning to credit card rewards programs to make ends meet.

How inflation is fueling the popularity of rewards credit cardsAs Americans continue to feel the cost crunch of inflation, many people are turning to credit card rewards programs to make ends meet.

Consulte Mais informação »

Economist Warns the Fed Can't Reach Inflation Target Without 'Crushing' US Economy – Economics Bitcoin NewsEconomist Mohamed El-Erian has warned that the Federal Reserve cannot get to its inflation target without crushing the U.S. economy.

Economist Warns the Fed Can't Reach Inflation Target Without 'Crushing' US Economy – Economics Bitcoin NewsEconomist Mohamed El-Erian has warned that the Federal Reserve cannot get to its inflation target without crushing the U.S. economy.

Consulte Mais informação »